Latest Posts

Foodex Japan 2023

SKINCOMM UNICEL System: Science-Based Skincare for Radiant, Healthy Skin (Review)

Introducing SKINCOMM® UNICEL System: Science-Based Skincare for Radiant, Healthy Skin Are you tired of using numerous skincare products without seeing the desired results?…

Polpette fritte di Cannavacciuolo, “Cosa metto al posto dell’acqua e del pane”. Ancora più morbide e buone, Il segreto

Le polpette sono buone in qualsiasi modo le cucini. C’è chi le preferisce di carne, chi di pesce, chi vegetali. C’è chi le…

John T. Edge Toasts a Birmingham Bar Where Patrons Are the Stars

Feizal Valli pushes aside a thatch of plastic reeds and steps through a green curtain printed with ferns and banana plants. Black-and-gray hair…

Honoring Tradition: The Oldest Living Mambabatok Graces The Cover of Vogue Philippines

The legendary Apo Whang-Od is the face of the magazine’s beauty issue, showing the depths of Filipino identity and history across generations, receiving…

Tunisia migrant boat shipwrecks leave 27 dead or missing

TUNIS, April 9 (NNN-AGENCIES) — Twenty-seven people are dead or missing after two migrant boats sank off the east coast of Tunisia. The…

Christiana Mall shooting: 2 in critical condition Saturday night; suspect not in custody

Delaware State Police have confirmed that three people were shot at Christiana Mall Saturday evening in what investigators do not believe was a…

Warning of summer storms in 14 provinces on Sunday

People in 14 northern, north-eastern and eastern provinces of Thailand have been advised to brace for summer storms and strong winds today (Sunday),…

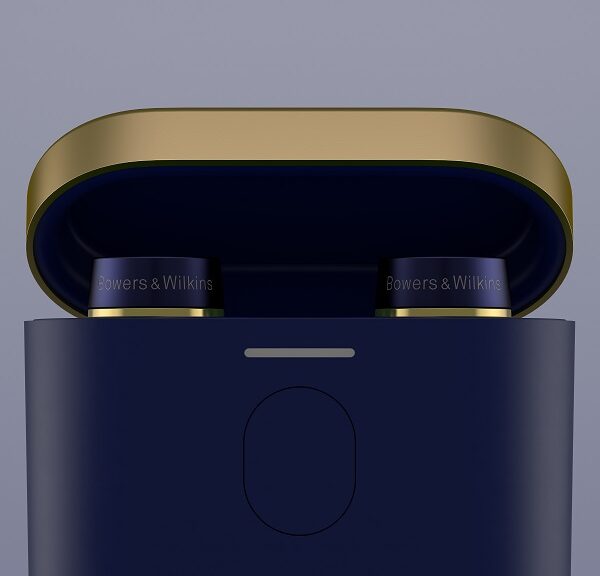

Bowers & Wilkins Pi7 S2 flagship True Wireless earbud Review

The Bowers & Wilkins Pi7 S2 is a flagship True Wireless earbud model that maintains its industry-leading hi-resolution sound while making significant upgrades…

Penny Wong condemns escalating violence and calls for calm in Middle East – Asia Newsday

Australia’s foreign minister, Penny Wong, has condemned escalating violence and terror attacks in the Middle East. Her comments follow rocket attacks fired into…

GLI USA HANNO PREPARATO L’UCRAINA ALLA GUERRA CONTRO LA RUSSIA PER 30 ANNI | NoGeoingegneria

La notizia è clamorosa. Documenti segreti, classificate top secret, degli Stati Uniti e della Nato sui piani per rafforzare l’esercito ucraino sono state pubblicati…

Featured StoriesAll posts

La Pasqua di Peck:un omaggio a Milano con l’“Uovo alla Milanese”

Peck interpreta la tradizione pasquale con nuove creazioni di alta pasticceria: uova, sculture di cioccolato e Colombe per regalare preziosi momenti di condivisione…

Come colorare le uova di Pasqua

Uova al Cioccolato e Colomba le proposte solidali per Pasqua di CasAmica

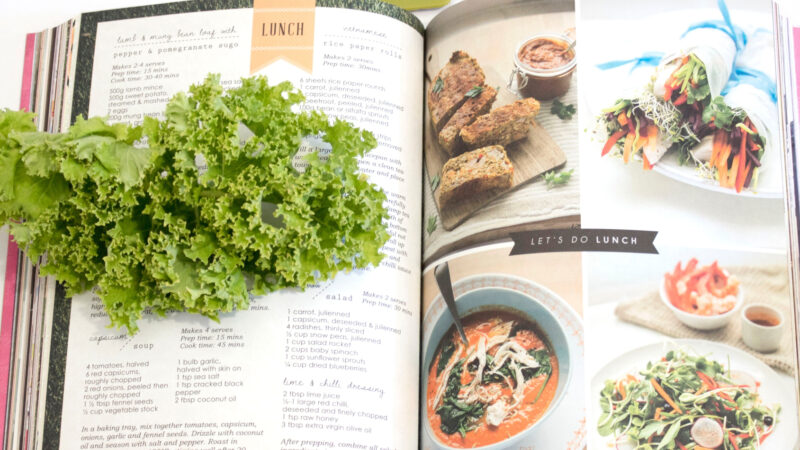

La dieta mediterranea

Gelato artigianale da record: in Europa sfiora i 10 miliardi di euro di fatturato

Tabella di conversione ricette Americane

Ricette con la zucca: 8 ricette facili e veloci!

Cioccolato benefici e proprietà

Cucina sana con le erbe fresche

TrufflEat

TrufflEat deals with importing and exporting food from Italy and exporting all over the world.

Follow us

SpotlightAll posts

Featured VideosAll posts

Crypto Analyst Says Asian Markets Will Make DeFi Blow Up – Asia Crypto Today

DeFi projects have been flying high since the start of the year, from Kyber Network to Aave, to Compound and Balancer, among many…

China Trust Blockchain Committee Establishes CCAL Super Ledger – Asia Crypto Today

The China Trust Union Alliance Blockchain Committee has recently disclosed the launch of a blockchain project called CCAL Super Ledger. Also known as…

Ride-Hailing Giant Didi to Test Out DCEP to its 550 MIllion Users – Asia Crypto Today

China’s ride-hailing giant Didi Chuxing will soon pilot the country’s national digital currency (DCEP) as one of its supported payment methods. When rolled…

CBDC Arms Race Escalates as DCEP Gets Tested by Two More Giant Companies – Asia Crypto Today

China’s DCEP appears to be on fire as two multi-billion dollar companies have planned to test out the digital yuan as a payment…

Reader PicksAll posts

Winds of resistance blowing? Afghan religious scholars criticise Taliban's diktat banning female education

The religious voices in Afghanistan are opening up against the ban on female education. Two prominent religious scholars on Saturday urged the Taliban…

India confronts Myanmar over construction of Chinese spy posts in neighbouring Coco Islands: Report

The Indian government recently confronted Myanmar over intelligence reports that China is constructing a surveillance military base in its Great Coco Islands, an…

Eight killed in deadly ethnic clashes in Bangladesh, police on toes fearing more violence

A deadly clash between two ethnic groups in Bangladesh has claimed eight lives and left scores injured. An additional police force has been…

Best Luxury Cruise Operators – Signature Luxury Travel & Style

Signature Luxury Travel & Style’s Luxury Cruise Awards 2022 celebrate the ocean, river, expedition, family and tall-ship cruise lines that go above and…

Thousands from Myanmar flee to Thailand amid fighting between military, rebels

This week, at least 5,000 people were forced to flee from Myanmar, amid fierce fighting between the country’s military and armed rebels, to…

China's proposed radar base in Sri Lanka to threaten India's naval assets

China has proposed setting up of a radar base in Sri Lanka, aiming to counter India’s naval presence and strategic oversight in the…

Pakistan cannot get 24/7 gas supply, rich people will have to spend more: petroleum minister

Pakistan’s Minister of State for Petroleum Musadik Malik said that the government cannot provide 24×7 gas supply throughout the country, reported The News…

What's next for Pakistan? Foreign Minister Bilawal Bhutto fears 'martial law'

Pakistan Foreign Minister Bilawal Bhutto Zardari expressed fears of emergency or “martial law” in the country if a larger bench was not constituted to…

Pakistan SC strikes down poll body’s decision to postpone Punjab elections, fixes May 14 as new date

Pakistan’s Supreme Court on Tuesday declared unconstitutional the Election Commission of Pakistan’s (ECP) decision to postpone the Punjab Assembly polls to Oct 8,…

PM Modi meets Bhutanese king in New Delhi, assures support to extend credit facility

Indian Prime Minister Narendra Modi met with visiting Bhutanese King Jigme Khesar Namgyel Wangchuck on Tuesday (April 4) in New Delhi at his…