Here’s a tidbit about the oil and gas industry that isn’t very well known: Oil wells are rarely plugged when the owners or operators are finished with them.

Instead, experts say oil companies generally sell low-producing wells to smaller, less sophisticated oil companies, according to industry insiders. And what about the ones caught owning a well at the end of its life? Apparently, most just abandon the well, letting it sit idle, never capped to avoid the expense. Indeed, the number of orphaned wells across the United States releasing methane emissions into the atmosphere has been estimated to be 120,000 or as high as 3.2 million by different reports.

Purveyors of a new type of carbon credit are trying to cut off that chain of events by incentivizing oil companies to plug wells instead of selling them or abandoning them.

But let’s back up and explain the life of an oil well. A story of many owners, according to industry insiders.

“Big Oil comes in, and they develop fields and develop areas, and they get the first production when the wells are producing a lot of oil,” said Martijn Dekker, who spent most of his career working at Shell before becoming CEO of ZeroSix, a soon-to-be seller of the aforementioned credits.

When a well is first drilled, the pressure is high and it produces a lot of oil. But when the pressure drops, the rate drops. This continues over time until very little oil is being taken from the well. According to Dekker, Big Oil doesn’t wait until the field dies. These companies move on to bigger and better wells and sell the low-producing ones to next-tier companies that are happy with less oil production per day. This typically happens a few times over the lifetime of a well, he said.

According to Dekker, smaller companies with lower costs can make the economics work when a well is only producing a few barrels a day, and they avoid the cost of drilling their own wells. Every company in between gets to punt the abandonment liabilities and costs to the next operator. According to the Natural Resources Defense Council, capping an oil well can cost anywhere from $5,000 or $1 million. And a study from Resources for the Future put the median cost at about $76,000. To cap a well, a company needs to use cement stoppers at different depths of the hole to plug the well from releasing gas into the atmosphere and water supply. The older, deeper and longer abandoned a well is, the more complicated and costly this process can become.

And it’s not just the abandoned wells that are an emissions problem. According to Sam Arnold, CEO of Carbon Path, another company that is working on creating a carbon credit for plugging oil wells, under this business structure, many oil wells are producing for decades longer than they should, creating immense amounts of methane emissions. The EPA estimates the total methane emissions from abandoned wells leaked from 1990 to 2020 to be about 276,000 metric tons.

Beyond the emissions related to oil extraction and combustion for energy, less productive oil wells often produce more methane than those managed more closely — often due to leaks and maintenance issues. According to Dekker, lower-producing wells are not as well maintained, because smaller companies have less money to identify leaks and to make sure a well is run as efficiently as possible.

“An Exxon Mobil, they’ll do everything to make sure that 1,000 barrels-a-day well operates perfectly,” he said. “That everything stays in the pipe, there’s no emissions, and they spend a lot of money doing that.”

A well that is only producing one barrel a day won’t get the same TLC. Each time a well drops its production rate and is passed to a new owner, the integrity of the operation is at risk, he said.

Dekker said big oil companies often try to show they’re becoming greener by selling their most-polluting wells. “But of course, from a global basis, nothing’s changed. Someone else is producing it, it’s just not on your books,” he concluded.

Right now, there aren’t any laws stopping oil companies from this “selling down the pipeline” strategy to deal with low-producing oil wells and very little was being done to force companies to stop abandoning the wells. However, the bipartisan infrastructure bill passed in 2021 did release $4.7 million in funding for states to plug their orphaned wells. Colorado is one of the only states with sweeping regulation for oil and gas companies related to this issue. In March, the state mandated that companies pay hundreds of thousands of dollars in taxes to cover cleanup costs, including plugging wells.

The business models upon which Carbon Path and ZeroSix are built is to create the carbon credit for the oil company after it plugs the well and take a percentage of the revenue when it is sold on the voluntary market.

Carbon Path and ZeroSix are targeting mid-sized oil companies such as Chesapeake, Devon and ConocoPhillips and offering their credits as a financial incentive to keep oil in the ground. They are pitching the credits as assets the companies can sell on the voluntary market to corporate buyers. Carbon Path plans to price each credit between $20 and $50 a ton, while ZeroSix is looking at $10-$20 a ton per CO2 equivalent of methane.

At the end of the day, they’re not going to have any new money to go drill new wells. Every dollar that credit generates is going to go to plug the well.

“That [price range] is the equivalence point where it would be more advantageous for a producer to [plug the well for a credit] and sell it in the carbon markets than continue producing oil,” Dekker said.

The oil well-linked carbon credits from both Carbon Path and ZeroSix will cover the carbon emissions avoided by leaving fossil fuel reserves in the ground, but Carbon Path’s credit will also cover the methane emissions that leak from abandoned wells.

ZeroSix is taking the more conservative approach because, according to Dekker, there is a lot of debate around calculating the emissions from methane leaks. Arnold agrees.

According to Arnold, that gases in an orphaned oil well build up pressure over time. The well then “belches” to relieve the pressure, releasing the methane into the atmosphere. The cycle repeats over and over, but it can be infrequent and hard to predict when methane will be released. This makes verifying emissions rates difficult.

Neither credit accounts for the carbon benefit of avoiding the transportation required to distribute oil or ending the energy required to run the compressors during oil production. These are seen as co-benefits. And because oil wells are regulated by the state, every credit comes with a state permit recording that it was capped.

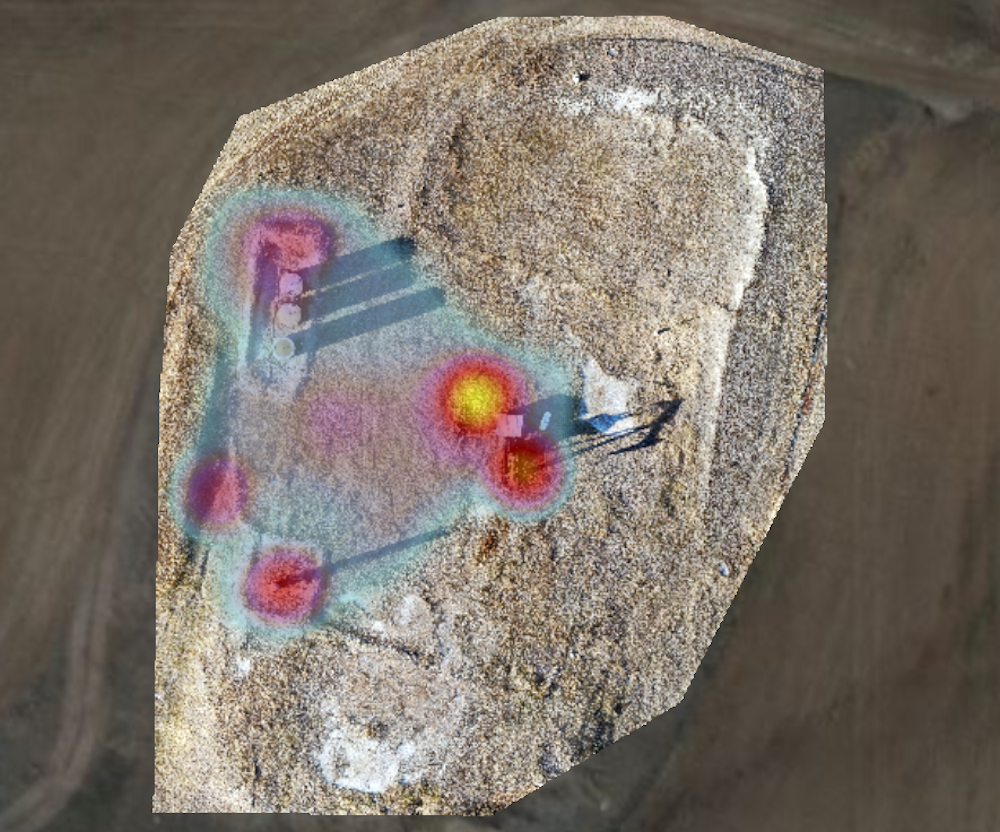

Carbon Path finished a two-well pilot project in Montana in October and is waiting on the state permit to issue the credits. ZeroSix is shooting for the middle of next year to issue its first credits.

Creating this new type of credit hasn’t been without its challenges. Arnold mentioned that many carbon credit buyers have moved on from avoidance credits in favor of those supporting removals, and he has had trouble attracting interest from corporations for this reason.

“People will automatically call this credit [an] avoidance [one],” he said. “I disagree with that. Because if you don’t do anything, the world gets worse off every year. So it’s not that the world stays the same.”

The other issue Arnold is encountering is what he describes as the weird feeling people have about giving more money to oil companies. But the credits will financially incentivize those companies do things differently, he said. And Arnold also believes that the money isn’t going to oil executives.

“At the end of the day, they’re not going to have any new money to go drill new wells,” he said. “Every dollar that credit generates is going to go to pay contractors to go do work to plug the well.”

At least that’s the theory. We really don’t know what an oil company will do with the money from its credit, especially if the credit is selling for higher than the cost of capping the well.

That points to another big issue for this new type of credit — potential leakage. Will plugging these wells just lead to the drilling of new wells elsewhere? A study from the Stockholm Environment Institute estimated that if all oil production in California stopped, about 0.4-0.8 barrels would be produced elsewhere for every one of California’s barrels that wasn’t produced. So it does seem that limiting oil production would decrease oil production somewhat.

But more important, it takes a huge capital investment to drill a new well — anywhere from $2 million to $12 million depending on depth, length and other environmental obstacles. According to Arnold, it still costs more money to plug a low-producing well than to just keep it operating and making a little bit of money. The credit is supposed to balance out those costs by making plugging an oil well more lucrative than keeping it producing — but not creating enough money to cover drilling a new, higher producing one.