For lithium that change happened in 2018, which, for one, shows just to what extent the EV industry is still in its infancy, and two, just what an impact the additional demand from EVs will have on raw material prices.

Benchmark Source, a new service from the London-HQed battery supply chain research firm, reports that lithium prices in China touched a fresh record high mid-November, just shy of $80,000 a tonne.

Prices of Chinese battery grade lithium hydroxide, which is used in high nickel cathodes, are up 150% year-to-date. Lithium carbonate prices have followed a similar trajectory. While well below their Q1/Q2 highs, nickel and cobalt sulphate prices have also regained some ground since hitting 2022 lows in Q3.

Cathode cost climb

Lithium iron phosphate (LFP) batteries have lost some of their cost competitiveness to ternary cathodes using the dominant nickel-cobalt-manganese (NCM) chemistries due to the rise in the price of lithium.

According to Benchmark’s Cathode Price Assessment, high nickel content NCM 811 (8 parts nickel and one each cobalt and manganese) cathodes could be had for $78.64 per kWh on the spot market in October this year. That’s up nearly 18% year to date and a doubling since January 2021.

For LFP, which is close to hitting $50 per kWh today, was only priced at $12.79/kWh in January 2021, which means LFP cathodes are up 288% in less than two years.

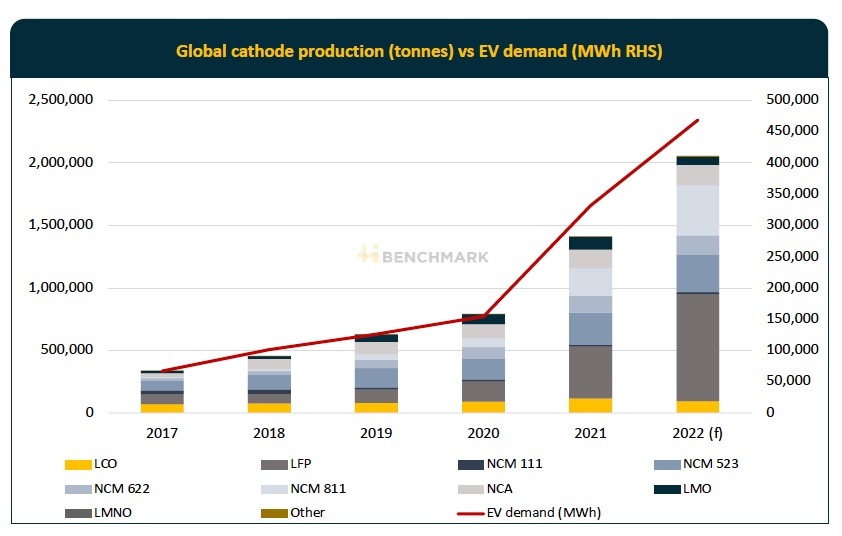

Driven by advances in battery packs to overcome some of the drawbacks of the chemistry in terms of energy intensity, LFP’s overall cathode market share has climbed from 23% in 2017 to nearly 42% this year, according to Benchmark data.

Cathode CAGR tops 40%

Caspar Rawles, Benchmark’s Chief Data Officer, told the conference audience that global cathode production has increased at an annual compound rate of 42% since 2017 and is forecast to top 2 million tonnes this year.

Even that astonishing growth has not been enough to satisfy rampant demand growth from electric cars. Rawles said EV battery demand has really accelerated since 2020 as incentives and regulations in China, Europe and the US caused a step change in auto sales and battery manufacturing capacity.

Global EV demand measured in kWh expanded some 23% in the four years through 2020, but in the past two years the compound growth rate has climbed to just under $45%.

IRA

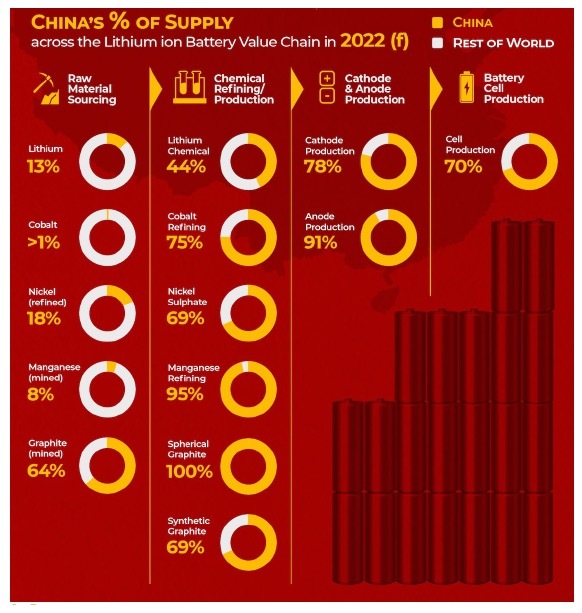

China’s dominance in cathode manufacture is only slowly being chipped away despite the steady stream of announcements of billion dollar battery factory projects in Europe and North America.

China controls 78% of global output of cathodes (the figure for anodes is 91%) and 70% of the world’s cell production.

Rawles says there are various efforts in the West to decouple from China, including Canada ordering China to divest from the country’s lithium industry, $2.8 billion in grants and many times that in loans from the US Dept of Energy, critical mineral grants under the Defense Production Act, $60 billion in cumulative Environmental Justice Initiatives and $6 billion in credits for up to 30% of manufacturing projects capital expenditure under the Inflation Reduction Act.

Rawles said the IRA that “shake[s] up the industry” and the US and global EV supply chain, and in particular draws attention to Section 45X – Advanced Manufacturing Production Tax Credit, which makes available around $30 billion in tax credits:

“While there is still some information to come out [regarding detailed provisions in the IRA] as a refiner, if you source your materials in the US and you process them to battery grade you’re eligible for 10% of your operating costs.

“But there is no sunset clause on that so theoretically, until the law changes, you can get ten percent of your opex for your lithium refinery for example in perpetuity.”

America first

The IRA has already provided a big boost to the development of the US battery supply chain, with the US overtaking Europe in the second half of this year in terms of announced new battery capacity. The US battery pipeline is nearing 1 terawatt hours, according to Benchmark.

LG Chem’s recent decision to build a $3.2 billion battery cathode facility in Tennessee alone could more than double North American cathode production when it goes into production in 2027.

Benchmark calculates the plant could supply 18% of North America’s 2030 cathode demand if it operated at its full announced capacity of 120,000 tonnes a year.