By Boon Sian Chai, Managing Director and Vice President (International Markets) at Trip.com Group

At the time when international travel returns and great challenges in the world economy unfold themselves, I will share an overview of global travel market and trends that have emerged post pandemic. I will also share insights on Chinese outbound travelers and what travel companies can prepare now for the time China opens their borders to the rest of the world.

Global Market Overview

1. A new era of travel

With travel restrictions being lifted in most parts of the world, a new era of travel has begun.

The United States has reopened its borders to vaccinated foreign travelers since November 2021. Canada lifted all entry regulations in September 2022; at the same period of time, Hong Kong announced the “0+3” model where arrivals can choose to undergo three days of medical surveillance at home or in a hotel, during which they are free to go out but cannot enter places such as eateries. Japan finally reopened its borders to independent foreign travelers and reintroduced visa-free entry in October 2022.

We have seen a surge in travel demand across the globe amidst the easing of COVID-19 restrictions. Tourism recovery is accelerating in Asian markets, and I think Asia will be the next region that will overtake 2019’s numbers over the next six months to a year.

2. Improved international tourist arrivals

International tourist arrivals for the Asia Pacific region, compared to 2019, are about 70% of what it was in 2019. Middle East and Europe are the regions that are recovering better than the other. However, if you look at the charts below reporting Asia Pacific only, over last few months, the numbers have started to pick up quite drastically.

At the same time, if we look at the sentiment of travel, Asia is the next region there’s going to really give us a travel boost. Travel sentiment for Asia Pacific is ranked the highest across all the other regions. There is a lot of tailwind in terms of how Asians are looking at travel when many of the travel restrictions are removed.

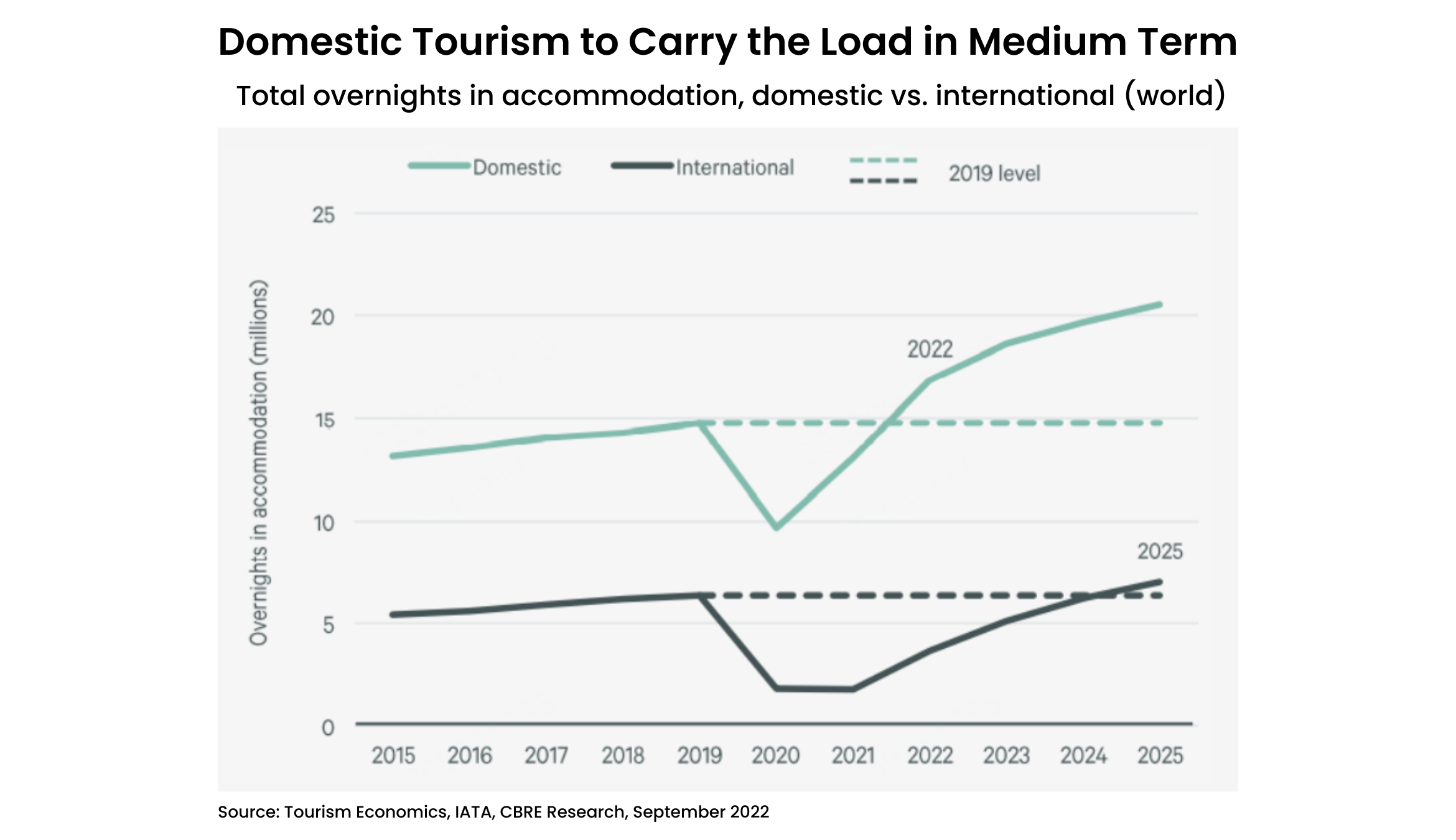

To give you an idea about how international room nights as well as domestic room nights are trending, that green line below shows that 2022’s domestic overnights have already surpassed 2019’s, meaning that more people are staying domestically overnight in 2022 as compared to 2019—more people are already travelling domestically versus 2019 itself.

For international travel, we still have somewhere to go. Based on data from Tourism Economics and the International Air Transport Association (IATA), we see that probably the U.S. and Europe will be the regions that will pick up faster and they will overcome 2019 numbers in terms of the international room nights.

Such recovery and growth are natural because Europe and America were the regions that first opened their borders and first seen travel mostly return back to normal.

Now that’s the global trend. Let me share with you some insights we draw from post-pandemic travel industry trends and the changing consumer behaviors.

Post-Pandemic Travel Industry Trends & Insights

1. Non-urban destinations and alternative accommodations are growing in demand post pandemic.

It’s an age-old question: “Business or pleasure?”. For travel companies these days, many of the trips now are the combination of work and leisure.

After more than three years of COVID-19, people have gradually adapted to living, working and travelling under the “New Normal”. Travellers now opt for “Bleisure”, trips blending personal getaways with remote work, which determines their choice of destinations, accommodation and the length of stay.

We are now seeing people going on 2-week trips to non-urban destinations, where during their holidays, they are actually working remotely. Traveler’s choice of destinations has changed. Their length of stay per trip has increased. The lines between leisure and business travel are definitely blurred.

Travelers increasingly prefer alternative accommodation such as short-term rentals, long-term rentals and serviced apartments over traditional hotels.

2. Hotels go online.

Besides bleisure, another trend post-pandemic is the rise of online adaption. Hotels are adopting technology and going online.

A wide range of hotel services are going from offline to online, including members services, social services, e-commerce services, various types of room services, as well as information sharing. You will start to see less and less of hotel brochures because (i) hotels are moving online and (ii) it is about sustainability.

In fact, travellers and hotels are influencing each other; where travelllers’ preference of online booking experience changes the way hotels are operating, and the rise of online adaptation results in the changing behaviours of future travellers and hotel operators post pandemic.

3. Gen Y and Gen Z lead the way in tourism recovery.

Now, I would like to talk about Gen Z and Gen Y.

Gen Y are people born after 1980, and Gen Z are people born after 1995.

On the bottom left, you will see the global population share by generation where baby boomers and our Gen X are still forming the majority. However, the combination of Gen Z and Gen Y is over 60%.

More prominent is the chart on the right. If you look at 2020 versus 2021, the segment that is growing aggressively are Gen Z—from 23% of online booking distribution in 2020, they accounted for more than 28%. The dominant forces are Gen Y who drives the online bookings going forward. Hence, it’s very important that we focus on these consumers, making sure that we know their travel preferences and purchasing behaviours thoroughly.

3. Trendy technologies attract both Gen Y and Gen Z, but Gen Z consumers care more about social connections during the journey.

We all know everybody now is using a mobile phone. In fact, I once heard from a colleague that one of his sons (Gen Z) was doing his homework on mobile phone. Could you imagine that? I think if we asked ourselves 10 or 20 years ago: “Can we do our homework on mobile phone?”, we would be saying “That’s not going to happen”. But it is happening now.

If you look at a white line—which is the Gen Z, or those born after 1995, they are looking at playing hard and having pleasure. Gen Z spend most of the time navigating their life on mobile phones, which includes developing social life and playing games across different apps. Thus when Gen Z travel, they have the same quest for security needs and social needs.

It is, however, the reverse for Gen Y, who prioritizes health in particular. By observing which group of people is wearing masks more often during the pandemic, you will be able to see the kind of consumer behaviors and the risk appetites of Gen Y as compared to Gen Z.

5. Booking windows gradually return to 2019 levels.

How is booking window trending now? On the left chart, you will see our European sites. In January 2022, as far as flight trends were concerned, the booking windows were close to 29 days; and for hotels, 15 days. Generally, the booking windows for European travelers are much higher than those in Asia Pacific. I think part of the reason is because of the tailwind of Europeans’ opening up, and hence the booking windows for European sites are higher. However, Asia Pacific is also not far behind. In the same period of January 2022, booking windows are more than 15 days for flights and for hotels, it is about 10 days. I think slowly, but steadily, we will also see these numbers picking up.

Don’t you agree that these are very attractive trends as compared to how it was during the pandemic?

During the pandemic, it was primarily domestic last-minute bookings because people were worried about how the situation would pan out domestically and many of them were looking at staycations. As such, the length of stay, the booking windows were as short as two or three days, or even one day.

Potential Opportunities for China Outbound Travel

I will dedicate the third part of this article on sharing insights on China’s travel market.

Before we look into China, let me share with you our observations on other markets. We are seeing international room nights exceeding 2019’s levels, and the huge growth—triple digit growth—is seen in Singapore, Malaysia, South Korea, Thailand, and Europe. These markets will very much likely to continue that kind of growth towards end 2022 and going forward to 2023. It is a very positive outlook for the travel market in Asia Pacific.

Now, what about China?

If you go back in time to pre-pandemic, mainland China had been the region with the most outbound travelers for six consecutive years. Hence, it is important not to forget that we have to prepare for the reopening of this market where the number of outbound travelers is 160 million people and the spend is about US$260 billion.

1. High purchasing power

The charts above show us the high purchasing power of Chinese outbound travelers, as drawn from our platform user profiles.

Besides the numbers, you can also look at the consumer behaviors and their demographics. The gender is quite even—about 46% of Chinese outbound travelers are men, and 53% women.

However, big differences are seen in their hotel choices and the amount they are willing to pay. We see 29% Chinese outbound travelers are willing to pay for the highest price range—above US$145 per room night. If you look at the star ratings, 90% of them choose between 3- to 5-star properties. Our internal reports also show that 60% would opt for 4- to 5-star properties. Consumers are really looking for premium and luxury products, not the typical hostels. This gives you an idea of the purchasing power, the potential demand and the opportunities Chinese outbound travelers would bring to the global travel market.

Now, what about memberships?

On the left, you will see the repurchase ratio from our platform users. From platinum tier onwards, the repurchase ratio is at least 70%, which means there is a 70% chance that any of our platinum members will actually repurchase. That is indeed a very high possibility that they are going to come back and make many travel purchases throughout the year.

On the right, Chinese travellers spend US$9,000 to US$75,000 a year just on travel itself—a very high spending per year.

Again, I know we do not know when China will reopen the borders, but I would like to emphasize that it is vital for travel companies worldwide to stay prepared to capitalize on the opportunities to win the hearts of Chinese outbound travelers when they start to travel again.

2. Targeting Chinese consumers

Now you may ask, “If I really want to target the Chinese consumers, how should I actually target them? How should I market my deals? How should I market my value adds? How should I market my properties, my partners, my destinations, and my travel products to these customers?” My answer is, we can take a three-step approach, especially in the domestic China. First, we ask for Super Deal, then we do Micro Targeting, and then we increase the Share of Voice by going through different apps, offline channels, and via some of our partners in terms of getting share of voice itself.

The vision is a local focus and the global vision. Let me share a little bit more detail on how this works.

a. Super Deals

Super Deals does not mean it is just about price only. It can be great value adds, it can be breakfasts, it can be upgrades. What we are really looking for is something that is of value and makes sense to the customers. When they see this deal, they would say, “Hey wow, this is something that really makes a difference. I want to make a purchase.” Of course, price is one of the main determining factors. However, other than price, it is also important that the deal is a value deal—something that people would say, “Hey, that’s valuable.” If a hotel deal is a value deal, it will be posted all over all the blogs in China—Little Red Book, Weibo, Wechat, etc. Everywhere people will start talking about this particular deal itself. So naturally, there will be a social network that will promote these deals that are being featured. Once we can evaluate how valuable these deals are to the customers, we will push them through different channels and drive traffic to them. We can do cross-sale bundle on our travel platform, making it a one-stop-shop for all travel products. We can also tie the deals with other travel and exhibition products. We can also tie the deals with car rentals, and the list goes on.

b. Micro-targeting

Now, let’s explore how we do micro- targeting. As I shared earlier, we have hundreds of millions of members. What we do is we actually look at the user profiles, their age range, their demographics, their behaviors, their hobbies, etc. Through data analytics and AI, we target them with direct deals, particularly tailored to the destinations they are search, their hobbies, their likes, their content browsing history. Through AI, we will push the right news to these customers and finally drive transactions. This is really how we push the right value deals to the right potential customers.

c. Share of Voice

We capture share of voice through various means on various channels. For example, we push app open ads, app banners and app ads via distribution channels, live-streams and search engines.

The intent is to really push deals of destinations, hotels and other travel products to the customers. Other than pushing Share of Voice on our own networks including the partners’, you can do so via KOLs (Key Opinion Leaders) and other external channels, some of which you are already familiar such as TikTok, QQ, Baidu, Weibo, and Wechat Alipay.

User-generated content is also a powerful Share of Voice. Thus travel brands targeting Chinese consumers should find ways to engage the consumers, which can be done via social media but also offline channels including subway, community centres, taxis, elevators, the malls, and so on.

Whether Super Deals, Micro-targeting and Share of Voice are done online, offline, within our networks, outside of our sources—anywhere, the point is, we should try to capture and engage as many as possible all the potential Chinese consumers, so to get ready for the growth of China’s outbound travel market once the borders are open.

Explore all the potential opportunities. There is nothing that we cannot imagine.