In a new note, BMO Capital Markets points out molybdenum has been one of the strongest base metal performers in the recent past with the latest spot assessments at ~$32 per pound or $70,500 per tonne – more than 50% higher than November-end levels.

Molybdenum is often produced as a byproduct of porphyry copper mines with global production worldwide of 300,000 tonnes primarily destined for the steel industry.

BMO says with demand conditions still relatively muted due to softness on global steel markets output, the price surge for molybdenum is mainly driven by supply issues:

“With the ongoing output challenges at Codelco, responsible for ~50% of Chilean molybdenum supply, Chilean output remains well below the five-year average, though November did mark a return to y/y growth.

“Meanwhile, Peru’s output is also down y/y, while other key primary producers such as China and the U.S. are also facing production headwinds.”

BMO says the the gains in molybdenum should help by-product credits at many copper operations, reducing headline costs and profits at producers.

Copper mining stocks on a tear

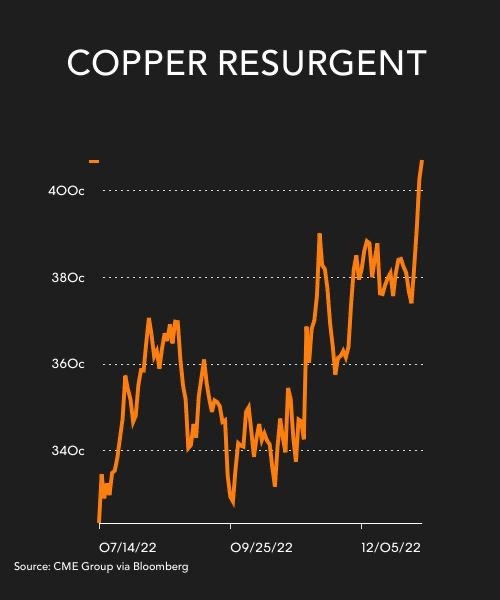

A revived copper price is boosting the sector’s top producers, led by Southern Copper Corp (NYSE:SCCO) which is up 18.8% so far in 2023. Southern Copper, headquartered in Mexico City, is the world’s fifth largest copper producer in terms of volume.

Freeport-McMoran (NYSE:FCX) traded up nearly 4% on Tuesday in heavy volumes of almost 9 million shares by early afternoon. The Phoenix-based company is the world’s second-largest copper producer after Chilean state company Codelco and is up 16.8% just in the past week.

Investors in London-listed Chilean producer Antofagasta (LON:ANTO) are enjoying double digit gains in 2023 as are those who took a bet on Poland’s KGHM (WSE:KGH), which has gained 17% in Warsaw this year.

Even First Quantum Minerals (TSE:FM), locked in a bitter dispute with Panama over government revenues from the Vancouver-based company’s 300,000 tonnes per annum copper mine, is up 9% in 2023 as investors bet on a swift resolution.

Zijin Mining (SHA:601899,HKG:2899), which at around 500,000 tonnes per annum is the world’s ninth largest copper producer, last year acquired the world’s largest primary molybdenum-only mine with annual output of 27,200 tonnes per year. Shares of rapidly-growing Zijin, which is also a significant precious metals producer, are up 8.3% in Shanghai year to date.