[This article is part of a series by members of the First Movers Coalition. You can read more stories about the initiative here.]

On Nov. 27, a small piece of aviation history was made: Rolls-Royce conducted the world’s first test run of a modern aircraft engine powered purely by clean hydrogen. Although the technology is not expected to be commercially viable until the mid-2030s, this test takes the aviation industry a step closer to the holy grail of zero-carbon, long-haul flight.

With clean hydrogen-powered passenger flight more than a decade off, the near-term net-zero hopes of the industry are pinned to sustainable aviation fuel (SAF). This article examines how to accelerate both supply and demand for this revolutionary way of powering aircraft — at the speed and scale demanded by a 1.5 degrees Celsius-aligned pathway.

Aviation agrees to change its flight plan

In the six decades from 1960, the number of passengers traveling by air proliferated from 100 million to over 4 billion in 2019. The International Air Transport Association (IATA) predicts passengers will surpass pre-pandemic levels after 2024 and could exceed 10 billion journeys by 2050. While aviation’s benefits to global trade and understanding are beyond doubt, they come at a price to the planet.

In 2021, aviation accounted for over 2 percent of global energy-related CO2 emissions, according to the International Energy Agency (IEA). When you add in the warming effect of the contrails created by the combustion of fossil jet fuel at high altitude, aviation’s global warming impact increases further. In recent decades, aviation’s emissions have grown faster than those of road, rail or shipping, surging in Europe, for example, by 24 percent from 2005 to 2019. Despite a 40 percent plunge during the pandemic, the IEA expects aviation’s emissions to surpass 2019 levels within a few years — without any abatement, they could triple by 2050. Aviation needs to change its flight plan — and fast.

Although aviation was left out of the Paris Agreement on climate in 2015, the industry agreed in September 2021 to commit to net-zero CO2 emissions by 2050. And in October, 184 governments came together under the auspices of the International Civil Aviation Organization (ICAO) to adopt the same long-term goal. This was an unprecedented move.

SAF represents less than 0.1% of global aviation fuel consumption today — a tiny step that needs to become a giant leap.

So much for the destination, but what about the flight plan to get there?

Earlier this year, the Mission Possible Partnership and the World Economic Forum (WEF) published the world’s first 1.5 degrees Celsius-aligned aviation transition strategy, backed by 70 corporate partners. The strategy maps out a “prudent” pathway towards 95 percent decarbonization by 2050, in which SAF plays a leading role (45 percent), with a variety of options to deliver the remaining emissions reductions, including fuel and aircraft efficiencies, clean hydrogen, battery-electric power for short-haul flights and optimizing air navigation.

Let’s take a closer look at sustainable aviation fuels and how they can bring the dream of low-carbon flight closer to reality.

Three priorities to make sustainable aviation fuel viable

Today’s commercially available SAF are typically biofuels made from vegetable oils or ethanol derived from crops such as sugar cane or corn. Depending on the feedstock used in their manufacture, they can already deliver a 60-85 percent reduction in CO2 emissions.

SAF’s great advantage is that it’s a “drop-in” fuel — you can pump it straight into aircraft fuel tanks without expensive retrofitting to aircraft or special infrastructure at airports. Current regulations only permit commercial aircraft to use a 50/50 mix of SAF and regular kerosene. But in March, Airbus successfully tested its A380 — the world’s largest passenger aircraft — with one of its four engines using 100 percent SAF. Airbus has conducted similar tests on other aircraft models and on a helicopter. In June, a Swedish regional airline completed the world’s first test flight with a commercial aircraft flying SAF in both its engines.

So much for the good news. The bad news is that SAF is still very expensive — anything between two and five times the 2019 price of conventional jet fuel. As a result, SAF represents less than 0.1 percent of global aviation fuel consumption today — a tiny step that needs to become a giant leap.

Airbus is among more than 100 companies, convened by the Forum’s Clean Skies for Tomorrow initiative in September 2021, that set a goal for SAF to meet 10 percent of aviation’s fuel needs globally by 2030. To achieve this, three things must happen:

- Scale-up supply: Production volumes must ramp up five or six times to hit the 10 percent target by 2030. This will require at least 300 new SAF plants.

- Reduce the cost: Fuel producers won’t invest in these new SAF plants without demand signals from industry. But airlines won’t buy sufficient SAF to send this signal unless the price comes down.

- Set clear market and demand signals from governments and companies: Governments must help kick-start investment in SAF production through a mix of incentives, tax credits and mandates. Leading aviation companies can commit to long-term offtake agreements to derisk investment by fuel suppliers.

First Movers Coalition sends demand signal for ‘super-SAFs’

To overcome the two key obstacles to scaling-up SAF — price and availability — someone needs to make the first move. In May, United Airlines was the first carrier to sign an offtake agreement with an overseas supplier for 50 million gallons of SAF for its flights out of Amsterdam. United and Airbus are among more than 50 businesses that make up the Forum’s First Movers Coalition (FMC), a global initiative to harness the purchasing power of companies to decarbonize seven “hard to abate” industrial sectors — including aviation — responsible for a third of the world’s emissions.

The FMC has set its sights on solving probably the toughest task in aviation — to boost demand for only those “super-SAFs” that can reduce life-cycle greenhouse gas emissions by 85 percent or more compared to conventional jet fuels. The target for FMC members is to replace at least 5 percent of their conventional fuel with these super-efficient SAFs (or another zero-emission technology if available) by 2030. The aim is to send a demand signal to fuel producers and investors so they have the confidence to invest in new plants and bring the prices down.

Every SAF process faces its own challenges to overcome. The two most common technologies (HEFA and Alcohol-to-Jet) rely on processing food crops such as rapeseed, soybean, palm oil, sugar cane or corn to create jet fuel. Since these crops are limited — and following the golden principle to avoid feedstocks that use land needed for other purposes — we have to look at complementary sources.

Two new technologies hold out potential to produce near-zero emission SAF: the Fischer-Tropsch (FT) and Power-to-Liquid (PtL) processes. FT’s advantage is that it can turn a wide range of “non-food feedstocks” — municipal solid waste, switchgrass, residues of forestry and agriculture — into jet fuel that delivers 90-100 percent CO2 abatement.

PtL, meanwhile, is a pilot-stage technology that combines green hydrogen (produced by renewable power) with CO2 directly captured from ambient air to create a synthetic fuel often known as “e-kerosene” — a virtually fossil-free power source. Airbus is part of a consortium that recently announced a new industrial-scale PtL plant in Hamburg. The advantage of PtL is that it requires no arable land or biological feedstocks. The challenges with PtL will be around cost and competition for green hydrogen from other sectors.

We need all certified pathways to stimulate the SAF market on a global basis — and there’s no time to waste.

Sustainable aviation needs support from states and standard-setters

Now that over 100 aviation companies are committed to ensure that 10 percent of their global jet fuel supplies are SAF by 2030, the demand for a completely new type of fuel market is clearly there. Both traditional fuel producers and newcomers are beginning to respond. But companies can’t manage the transition to a net-zero pathway alone.

Governments could level the playing field between SAF and fossil jet fuel by offering incentives. In the U.S., for example, President Joe Biden’s recent Inflation Reduction Act (IRA) extended a tax credit of up to $1.75 per gallon for SAFs and, for the first time, tied the credit amount directly to the life-cycle emissions of the fuel to incentivize production of fuels with the fewest emissions. The effect will be to bring down the cost of SAF to nearly the highest price for conventional jet fuel. These blenders’ tax credits form part of the Biden administration’s SAF Grand Challenge to incentivize the production of 3 billion gallons of sustainable jet fuel and reduce aviation emissions by 20 percent by 2030.

Biden’s IRA also included a hydrogen production tax credit of $3 per kilogram of green hydrogen, which could make e-kerosene much more cost-competitive and accelerate the development of PtL. In subsidizing both green hydrogen and SAF, these tax credits are a real game-changer for the aviation industry that should be mirrored elsewhere to ensure a level playing field and to stimulate SAF production and uptake on a global basis.

Europe, meanwhile, is mulling over legal mandates. The U.K. government has announced a mandate starting in 2025 that will require aviation fuel suppliers to ensure their fuels include 10 percent SAF by 2030. Next year, the European Union plans to introduce a similar “blending mandate” that will require fuel suppliers to increase the proportion of SAF they supply to European airports, starting at 2 percent of all aviation fuel in 2025, rising to as much as 37 percent by 2040 and 85 percent by 2050. Under EU rules, any SAF that uses food crop-based feedstocks will be excluded.

While mandates could help level the playing field, to be effective they need to be accompanied by public investment in R&D as well as buyers’ incentives to develop what is still a very nascent market. The EU is also considering helping reduce the cost of SAF by offering free carbon credits under its Emissions Trading Scheme (ETS) that are equivalent to the CO2 abated by using sustainable jet fuel.

Common certification and accounting standards are also vital. A major challenge is that supplies of SAF are not yet available in many airports, leaving carriers that want to refuel their aircraft in a bind. An innovative approach to solving this problem — known as “Book and Claim” — permits an aircraft that cannot refuel with SAF to pay for another equivalent flight to fuel up from an airport that does have SAF. The airline paying for the sustainable fuel can then claim the CO2 reduction it brings against its net-zero pledges. Book and Claim is a very promising solution, but it needs international standardization to harmonize approaches. The Forum’s Clean Skies for Tomorrow initiative has recently published guidelines on accounting for and reporting on SAF-related certified emissions reductions.

With a combination of government tax credits and leadership from aviation companies committing to long-term offtake agreements with SAF suppliers, the market could take off rapidly. And not just in Europe and North America. To reach the 300-370 million metric tons of SAF it will take each year to decarbonize aviation, we will need countries all over the world to get involved in manufacture. The opportunity is there to create a brand-new industry with potentially millions of new jobs.

Other routes to the same decarbonized destination

While SAF is the most viable medium-term pathway towards reducing aviation’s carbon footprint, two other revolutionary near-zero fueling technologies are being developed: battery-electric and clean hydrogen.

While the weight of batteries is expected to limit electric-powered technology to short-haul routes only, battery-electric flight could become a commercial reality as soon as the end of this decade. United Airlines has placed an order for 100 battery-electric planes capable of flying 30 passengers for 124 miles — extending to 249 miles with a reserve-hybrid engine powered by SAF. Batteries could also play a major role to decrease the fuel consumption of bigger aircraft. This explains why Airbus and French carmaker Renault recently partnered to develop technologies related to energy storage, one of the main roadblocks for the development of long-range electric vehicles.

And then — as we saw at the beginning of this article — there is clean hydrogen. It can be used to power fuel cells that drive electric motors or it can be directly combusted onboard the aircraft. By weight, it’s three times more powerful than kerosene. But in gas form, its volume is a challenge — for transportation and storage, it needs to be cooled into a liquid at minus-423 degrees Fahrenheit, then converted back into gas prior to combustion. Hydrogen can also be converted into electricity via fuel cells, which in turn power an electric propeller. A fuel cell aircraft is particularly interesting as it generates no CO2 emissions or toxic nitrous oxides.

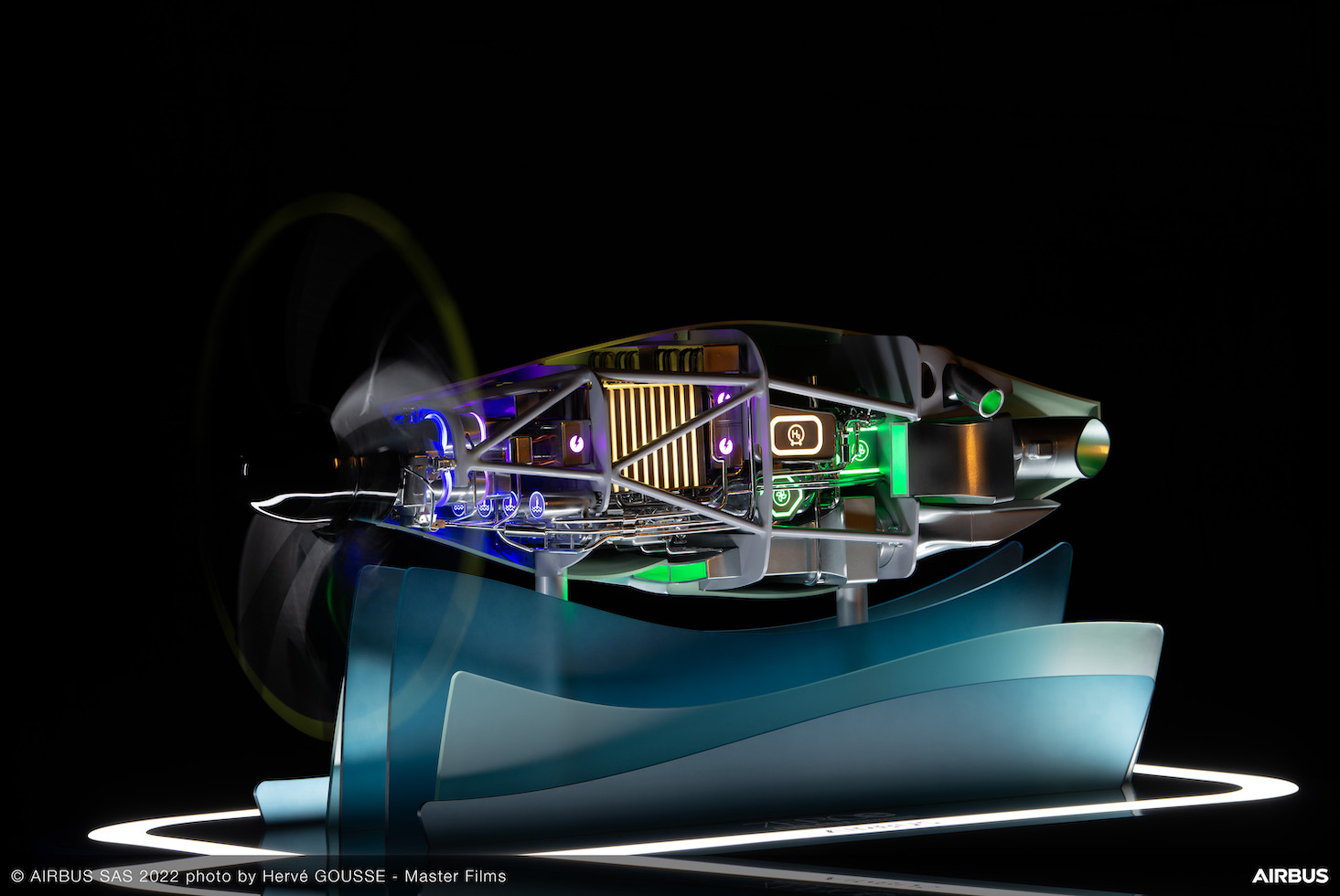

In May, Airbus launched its Zero Emission Development Centre in Bristol, England, with $828 million of funding support from the U.K. government, and the company is also conducting research in France and Germany, especially on hydrogen fuel tanks and propulsion systems. Airbus plans to conduct flight tests on an A380 equipped with one engine powered by hydrogen in 2026 — the first stopover en route to a commercial launch of Airbus’s ZEROe hydrogen-powered passenger aircraft targeted for 2035.

While there is no silver bullet to decarbonize air transport, each of these initiatives shows promise. But it will take long-term, coordinated action from airlines, aircraft manufacturers, fuel producers, airports and governments for zero-emissions flight to really take off.